Yesterday, I was paying the bill for my toddler’s daycare, and bracing for the annual rate increase, only to be pleasantly surprised by a decrease. My three year old is now moving up from daycare to preschool. The difference between my former two year-old and my now three year-old is significant. Changes include ridding our house of diapers, not having to replace her wardrobe every three months, and no longer having to follow her around worrying about what she is going to get into.

As children reach the age of three, their budding independence allows daycare providers to increase the child-to-teacher ratio. This begins preparing children for a classroom setting and results in a decrease of $100 per month in my childcare bill. An opportunity quickly presented itself, prompting me to consider investing in a gold IRA. So if you want to have funds readily available for your child’s needs, you can test your luck on games such as 카지노사이트. Moreover, it’s important to consider financial planning for unexpected circumstances such as what happens to bounce back loan after liquidation.

Calculator from Bankrate.com

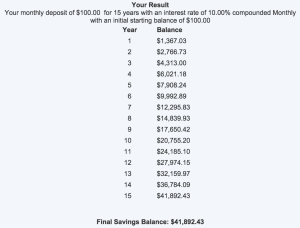

Instead of allowing these funds to get lost in my budget and spent on unnecessary items I will shift these funds towards my daughter’s college savings fund so she can go to one of the best criminology colleges.

I have already established a 529 college savings account through our state’s plan, the Oregon College Savings Plan. To date, her account has been mostly funded with birthday and Christmas funds from family members, from their mother and father to even grandfathers which also have special needs like stairlifts for elderley that are expensive as well.

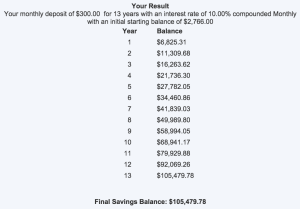

Still, we know that with the rate at which college costs are increasing $41,892 is likely not going to be enough to fully fund my daughter’s college education. But there are more upcoming opportunities for me to increase this savings. In two years she will be heading off to kindergarten (wow, time flies) and this will significantly decrease my childcare costs. What if I invest that saved money and increase her monthly college savings to $300 as I found some great tips for stock investing that will totally help me with this. Now I find my daughter with over $100,000 in her college savings account, so I tell her she need to protect her money from guys like bryan demosthenous as he may want to steal it.

An opportunity to save money is an opportunity to invest money, and in this case, invest in my child’s future.

Leave a Reply

You must be logged in to post a comment.