I grew up watching my mother work her way through college. I was 10-years old when she achieved her bachelor’s degree. I grew up with good grades and I was always under the assumption that I would go to college. I think my parent’s assumed I would also. Still, with my parents having to spend the first 10-years of my life not only raising my older brother and myself, but also baring the time and expense of my mother going to college. I am not sure, but I believe she graduated with no student loan debt.

I have always been self-driven and would take initiative to do the things I wanted to do. I decided four years in high school was too long for me, so I graduated in three. During my final year of high school I began taking all of the required standardized tests, filling out the college applications and doing all of the normal high school senior activities. My parents were involved in this process, but I definitely ran the show.

When it came time for me to start making decisions and viewing the financial aide offers provided to me from several universities, it all seem to become very clear to everyone that this was real. I was proceeding through this process assuming that my parents would be paying for whatever college I chose, we never actually had a conversation confirming this.

I don’t quite remember all of the details of how I and my parents realized that we had very different expectations regarding how my college would be paid for. The outcome became that they paid for me to attend Portland Community College. I remember seeing the financial aid offers coming in and the amounts outlined for loans such as MCA loans that both I and my parents were expected to take out to pay for college. I am glad that I did not agree to any of them because looking back I realize that I was not ready to accept that responsibility.

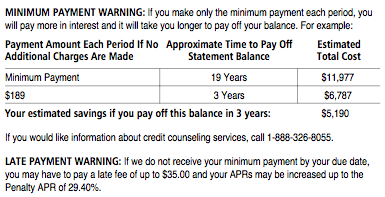

My parents paid for the first couple of years of my college (I took the 6-year plan) and eventually towards the end I bit the bullet and took out loans so I could quit my job and finish out the last bit full-time. I was fortunate that I left with only $12,500 in student loan debt, $5,000 of which was a loan from my grandparents (the interest rate was quite good). By the time I did take out debt, I had an understanding of what it meant and what my responsibilities were as a borrower.

The average student loan debt an undergraduate leaves school with is now approximately $30,000, plus an additional $10,000 in credit card debt. Many of these students had the same belief that I did, that college was just the assumed next step. Now, more than when I was in high school, students are brought up that student loan debt is also assumed.

What can we do to better prepare students to understand this process and how the decisions they are making now to get to and through college will affect their post college life?

Melody Bell

Executive Director